will capital gains tax rate increase in 2021

However it was struck down in March 2022. The Times reports that the Chancellor is considering an increase in the dividend tax rate by 125 and a cut to the 2000 tax-free dividend allowance perhaps halving it.

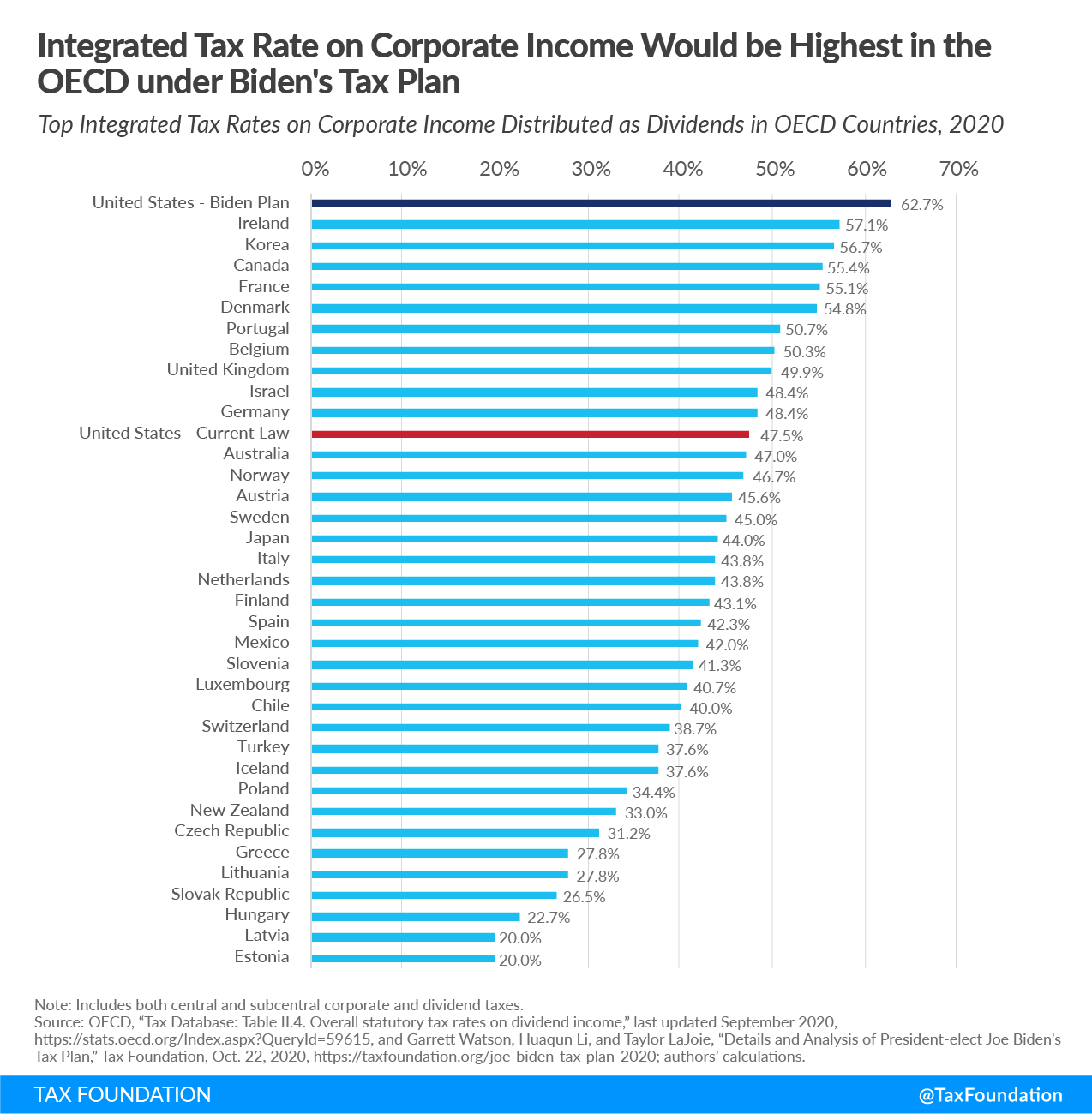

Biden Capital Gains Tax Rate Would Be Highest In Oecd

The proposal would increase the maximum stated capital gain rate from 20 to 25.

. Married separately taxable income. The effective date for this increase would be September 13 2021. The proposal would be effective for taxable years beginning after December 31 2021.

In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis. The income brackets are adjusted. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. Head of home taxable income.

Ad Compare Your 2023 Tax Bracket vs. By Charlie Bradley 0700 Thu Oct 28 2021. The dividend tax rates for 202122 tax year are.

Your 2022 Tax Bracket To See Whats Been Adjusted. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate. Experienced in-house construction and development managers.

If your ordinary tax rate is lower than 28. Knowing The Tax Brackets for 2023 Can Help You Implement Smart Tax Strategies. The Chancellor acknowledged the difficulties facing homeowners and businesses after the Bank put up its base rate from 225 per cent to 3 per cent on Thursday the highest for.

Basic rate payers and higheradditional rate payers. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. Most realized long-term capital gains.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. Experienced in-house construction and development managers.

Increase Tax Rate on Capital Gains Current Law. What is the dividend tax rate for 2021. Increasing the top capital-gains rate and lowering the income thresholds at which that top rate applies would raise 123 billion over the next decade according to an estimate.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Married joint taxable income. Over the 20202021 tax year the basic rate on. Assume the Federal capital gains tax rate in 2026 becomes 28.

Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high as 28. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

Will capital gains tax go up in 2021. CGT rates differ from income tax rates and are in two broad brackets. 2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains For Unmarried Individuals Taxable Income Over For Married Individuals Filing Joint Returns Taxable Income.

Ad If youre one of the millions of Americans who invested in stocks. The long-term capital gains tax rates for the 2021 and 2022 tax years are 0 15 or 20 of the profit depending on the income of the filer. Tax rate for capital gains.

75 basic 325 higher and 381 additional. Business acquisitions accelerate in response to President Bidens plan to double the long-term capital gains tax rate for those at the top from 20 to 40.

Real Estate Capital Gains Tax Rates In 2021 2022

Business Capital Gains And Dividends Taxes Tax Foundation

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Paying The Piper The Impact Of An Increased Capital Gains Tax Rate When Selling Their Business Rocky Mountain Business Advisors

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

What Are The Capital Gains Tax Rates For 2020 And 2021

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

Potential Increase In Capital Gains Tax Drives Business Owners To Seek Timely Exits Fe International

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Capital Gains Taxes White Coat Investor

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

2022 Capital Gains Tax Rates Federal And State The Motley Fool

September 13 2021 Update Democrats Propose New Tax Increases Srs

The Tax Impact Of The Long Term Capital Gains Bump Zone

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model